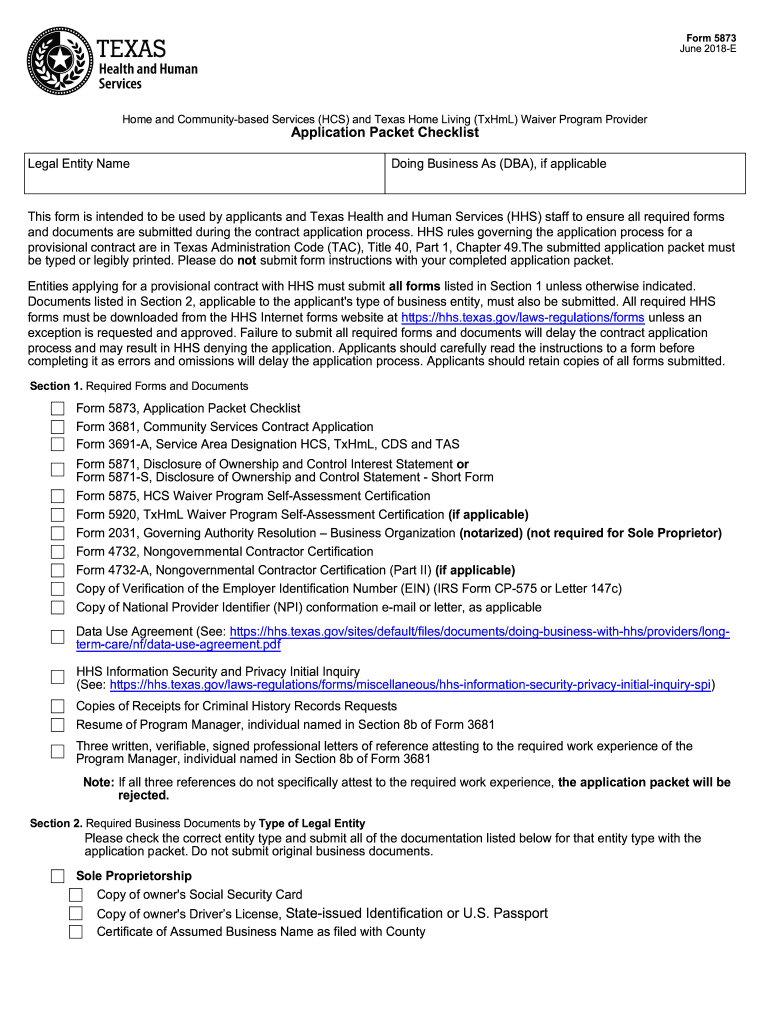

TX 5873 2018-2025 free printable template

Get, Create, Make and Sign form 5873 texas

How to edit TX 5873 online

TX 5873 Form Versions

How to fill out TX 5873

How to fill out TX 5873

Who needs TX 5873?

Video instructions and help with filling out and completing form 5873

Instructions and Help about TX 5873

I've been sent to spread the message MMM god bless Texas you all know were heading to the south when I start off by saying you all want something a little more regionally specific okay you all I just parked my truck outside a Hamburger on i-35 and this guy with the veto shirt walked by seeing my favorite Willy song and then out of nowhere a thunderstorm rolled in the temperature dropped by 20 degrees and then by the time I got home to do this video it was back into the 90s yep that's right folks today were ahead into Texas you might have seen some of our other videos where we guide you around a city and tell you what its like to live there well buckle up cowboy because today were doing the same for Texas and the Lone Star State is a hell of a lot bigger than any little old city in fact Texas is bigger than many countries combined so get out your Copenhagen your ratty old cowboy Jersey and pack your heat as we unbox this data Texas lets begin with some Texas stereotypes some of which are true and some of which are not to start things really are bigger here food portions trucks boobs hair houses and the number of miles you'll drive in a day food is serious business around these parts Texans have a genetic predisposition to love teamed for you all who don't know this is sorta like Mexican food but with a lot more cheese Texans don't f around with our barbecue breakfast tacos big bowl of margaritas and of course everyone here loves eating all things fried at the State Fair not everyone owns a gun, but some people certainly do people really do say you all its just more efficient people are just playing friendly here and when you're going down the street in somebody waves they don't want anything from you, they're just being nice and of course Texans are very independently minded after all if you recall Texas was once its own nation now what its like to live in Texas today is largely based on the states' history in 1519 Spanish conquistadors founded Texas which means a basically stolen from Native Americans who'd been living there for thousands of years between 1519 and 1865 all or parts of Texas were claimed by six different countries hence the name Six Flags now during that time there were a bunch of settlers and missionaries coming in from Spain then when Mexico gained its independence from Spain in 1821 Mexican Texas was part of the new nation after Mexico's leader Santa Ana started shifting politically to the right people in Mexican Texas wanted to revolt thus the Texas Revolution in 1835 oh yeah Texas won that's when Texas declared itself an independent nation the Republic of Texas one thing led to another there was a civil war in there and over the next century Texas gained wealth not from agriculture but from its plentiful oil and service-oriented society segregation ended in the 60s and between that time and now Texas went from a solidly democratic state on a nearly solidly Republic State these days Texas has both the second largest...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

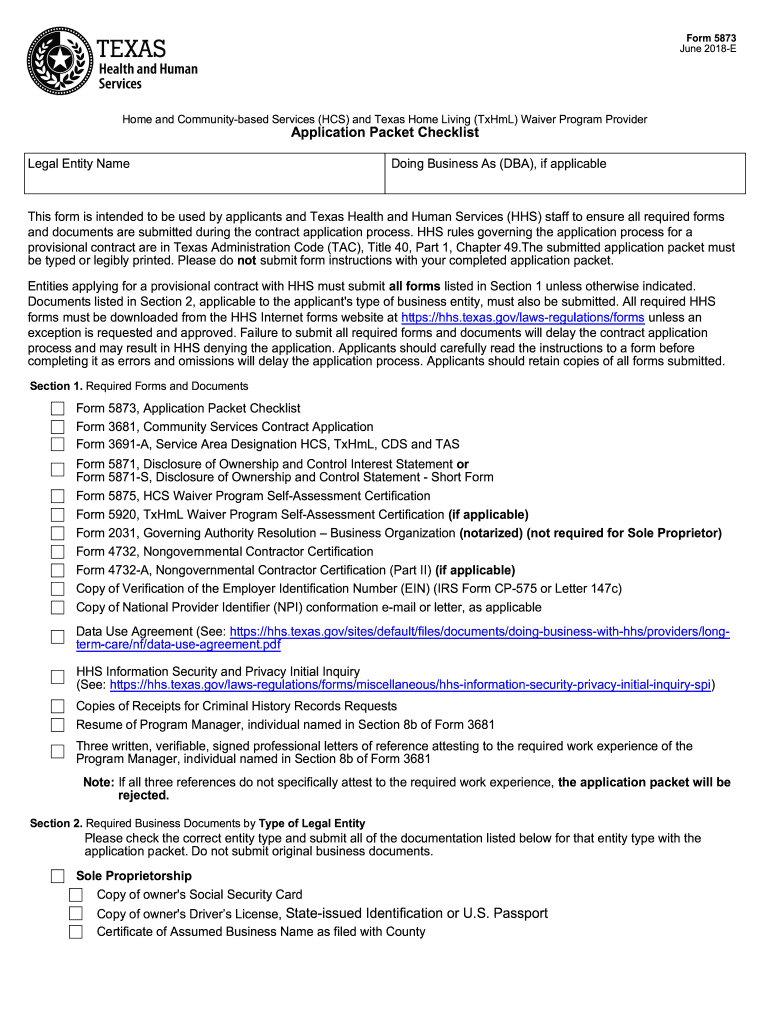

What is form 5873?

Who is required to file form 5873?

How to fill out form 5873?

What is the purpose of form 5873?

What information must be reported on form 5873?

How do I complete TX 5873 online?

How do I fill out the TX 5873 form on my smartphone?

How can I fill out TX 5873 on an iOS device?

What is TX 5873?

Who is required to file TX 5873?

How to fill out TX 5873?

What is the purpose of TX 5873?

What information must be reported on TX 5873?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.